27 Apr 2017

A report released today by APPEA exposes the damage a new tax would inflict upon Australia’s oil and gas industry.

“The report, prepared by respected energy consultants Wood Mackenzie, confirms that the new tax promoted by activists would deter new investment and damage the viability of existing projects,” said APPEA Chief Executive Dr Malcolm Roberts.

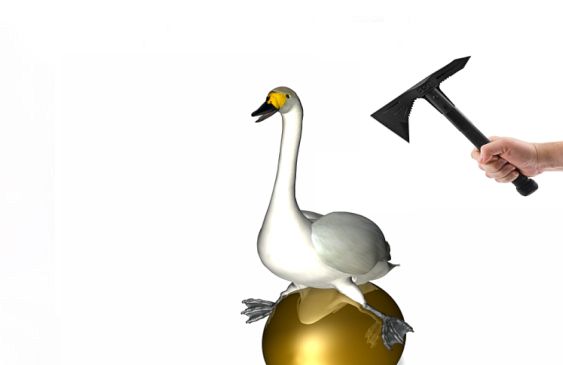

“Activists are arguing for a new 10 per cent royalty on all oil and gas projects in Commonwealth waters. Their arguments are simplistic, ignoring the costs of retrospective changes to long-established tax rules. Obviously, any tax increase will yield, for a time, more revenue – but at what economic cost?

“It would be penny-wise, pound-foolish to chase the short-term gain of more revenue at the cost of killing investment. The Wood Mackenzie analysis shows that the latest liquefied natural gas (LNG) projects are already well below normal rates of return needed to finance such projects; more taxes will further undermine these projects and therefore deter investment.

“Imposing a new tax amounts to a retrospective change to the arrangements that have been in place for 30 years. Such a glaring case of sovereign risk would deter footloose international investors. Australia is already a relatively high-cost place to produce oil and gas – adding political risk is likely to make us uncompetitive. Australia competes with 17 other LNG-producing countries.

“Increasing taxes on energy production must flow through to higher production costs and therefore higher energy prices. That will affect customers across Australia. In Western Australia, most gas used by domestic customers comes from Commonwealth waters. On the east coast, about half of the demand for gas is supplied from Commonwealth waters.

“The debate clearly must be balanced by an independent assessment of the likely impact of new taxes on industry investment.

“The Wood Mackenzie analysis finds gas projects are facing significant financial challenges. Large gas projects are high-risk, costing tens of billions of dollars but with unpredictable returns from volatile commodity prices.”

The following comments provide a reality check for those promoting a new tax on the industry:

“Any change to the terms will make future offshore LNG developments much less attractive at a time when even under existing terms their economics are likely to look marginal.

“Not only would the economics of these incremental projects be adversely affected by changes to the fiscal terms, but Australia would be seen as being much more fiscally unstable, with a willingness to let companies invest and then to change the terms after companies have made these massive investments.”

A copy of the Wood Mackenzie report can be found at this link.

In addition to the Wood Mackenzie report, APPEA has separately analysed a report commissioned by the International Transport Workers’ Federation (ITWF) from the McKell Institute to justify the case for a new royalty.

“The McKell Institute report relies on anecdotal comments and dubious material provided by its client, the ITWF,” Dr Roberts said.

“The report presents misleading information, misrepresents the nature of deductions under the Petroleum Resource Rent Tax (PRRT) and ignores the wide range of taxes paid by the gas industry.

“For example, while the report is titled Harnessing the Boom: How Australia Can Better Capture the Benefits of the Natural Gas Boom, it presents income data for the downstream operations of some companies. This is clearly misleading as the paper is focused on oil and gas production, not refining and retail sales.

“Most of all, it ducks the fundamental point that the PRRT was designed to maximise investment and, over the life of projects, revenue to government.

“The PRRT is a super-profits tax. It was never intended to be paid by all projects at all times.

“In combination with company tax, the PRRT imposes a tax rate of 58 cents in the dollar, once projects begin to achieve reasonable profits. Avoiding a crude, upfront royalty helps lower the initial costs for investment, encouraging rather than deterring projects in Australia.

“Such an important debate about such an important industry for Australia deserves rigorous, factual analysis, not simplistic arguments.”

Media Contact