20 Oct 2021

APPEA Tax Conference plenary highlights key industry mega trends

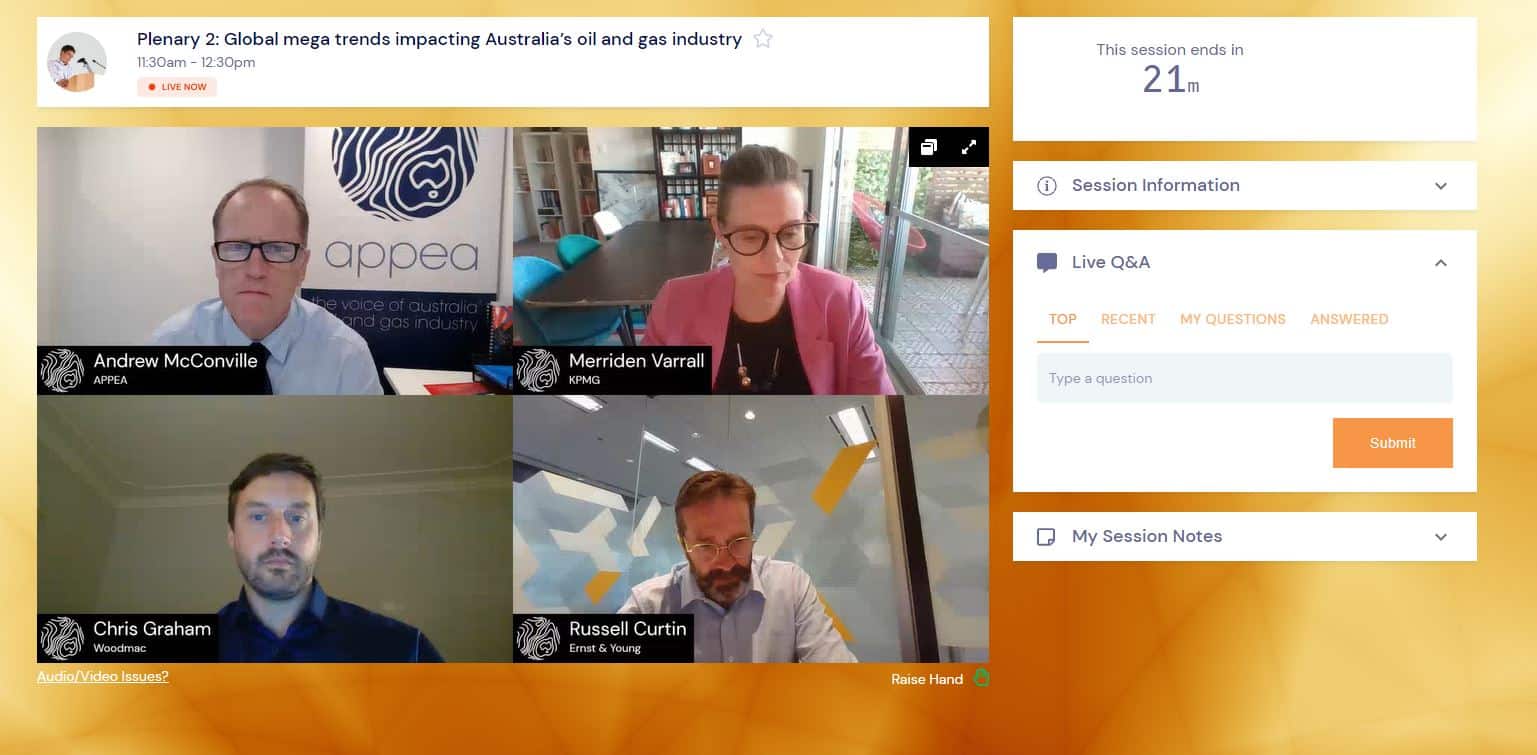

APPEA Chief Executive Andrew McConville yesterday facilitated a conversation between several industry experts on the global mega trends facing the oil and gas industry now and into the future.

The discussion took place as part of the ongoing 2021 APPEA Tax & Commercial Conference, with a session titled ‘Global mega trends impacting Australia’s oil and gas industry’.

Joining Mr McConville for this pertinent discussion were Merriden Varrall, KPMG Australia Geopolitics Hub Director; Russell Curtin, EY Partner & Energy Leader, Oceania; and Chris Graham, Wood Mackenzie VP Energy Consulting.

Each of these experts brought their own unique insight into several trends facing the current oil and gas industry, including facets such as the ongoing strategic competition between the US and China, global dissatisfaction and distrust, technology disruption, and climate change.

The plenary also provided an opportunity to touch on how best to balance the Australian oil and gas industry’s economic future – buoyed largely by Asian markets – with a political compass firmly lodged between Europe and the US.

First up was Ms Varrall, providing a broader regional perspective that included geopolitical and economic cooperation trends.

Ms Varrall emphasised the current systematic shift between rising powers who want more say in how the system works and resistant ‘status quo powers’, with particular reference to China and the US. Their relationship, which she said was at its lowest point “in decades” would be here to stay in the longer term.

Likewise, growing societal miscontent and inequality (both real and perceived), political shifts on both the left and right and increased mistrust in the elites were all providing fertile ground for a rise of populism set to continue in a post-Trump world, undermining domestic institutions designed to provide checks and balances.

Ms Varrall also said that emerging innovations and cutting-edge science would help to revolutionise the economy, leading to a kind of ‘Cold War’ for tech.

Mr Graham was up next to discuss the market perspective for Asia, which he referred to as an epicentre for global economic growth, rapid population growth and urbanisation. Mr Graham pointed out that by 2025, more than half the world’s urban population would live in Asian cities. In the next 15 years, the number of megacities (with 10 million or more inhabitants) was set to increase from 34 to 48 cities globally, including 11 in Asia.

He also explained that Australia was “well placed” to serve the needs of Asian energy supply, with the region providing a premium customer base with few domestic alternatives available to meet its energy needs. This, he said, give Australia the opportunity to be a stable partner for Asian economies so long as we remain responsive to their future energy needs.

Mr Graham said that Australia’s oil and gas sector should not take anything for granted, either, and work to target a requirement and opportunity to reduce Scope 1 and 2 emissions and differentiate its production as lower carbon, citing the recent success of the North Sea in establishing this.

Mr Graham concluded by saying that if Australia didn’t work to grab these opportunities, then its competitors would.

Finally, Mr Curtin focused on the domestic concerns. Mr Curtin explained that in the future licence to operate would become harder to obtain, with higher levels of demand and regulation as global markets continued to factor in financial risks of climate change.

He explained that companies would need to critically assess what gave them the right to produce, and that to increase investment attractiveness would take cohesive and effective policy settings, with EY research indicating a prize of as much as $350 billion and 220,000 jobs over the next 20 years should we get these settings right.

Mr Curtin also stressed that without a sufficient domestic gas industry to meet demands, manufacturing industry could move offshore, and Australia could lose out on a valuable opportunity to scale up a future hydrogen industry.

The three experts then joined Mr McConville for a Q&A session covering subjects such as China’s political pragmatism and the Asian market’s approach to climate change; private sector investment; the relationship between gas and renewables; and much more.

Of all the global mega trends discussed by our panellists however, all cited climate change as the primary topic of concern for the future of the industry, and that there was “no getting away from it”, in the words of Mr Curtin. With sentiments shifting, this remained the primary issue adding pressure to the industry, with the demand for greater action a prevailing trend that the industry must be prepared to meet.

For more information about the APPEA Tax & Commercial Conference (including how to register), visit https://www.appeataxconference.com.au/.